Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

In Reddit’s r/stocks forum, the social media network’s own users take a dim view of the company’s upcoming initial public offering. “RIP Reddit, it all goes downhill from here”, is the general view. Users expect public company status to result in more adverts and doubt the company’s ability to turn a sizeable profit. They should also be keeping an eye on the size of the float.

As the US IPO market stutters back to life, Reddit has renewed plans to list. The penalty for waiting is an expected $5bn valuation, half the value at which it raised funds in 2021. This cannot all be attributed to changes in market environment. Digital advertising growth at Facebook parent Meta, the world’s largest social media network, has pushed that company to a record high market cap.

Reddit, founded one year after Meta, was slow to attract advertisers and move to mobile, launching an app eight years after Facebook’s. With 70mn daily users, it has 2 per cent of Meta’s global audience. Revenue, mostly digital advertising with some premium subscriptions, is equal to just 0.6 per cent of Meta’s. In 19 years it has yet to report an annual profit, though lay-offs could produce positive net income in the final quarter of 2023 that would give listing documents a boost.

There are some benefits to waiting. Reddit has had time to move closer to profitability, clean up content and make the unpopular but lucrative decision to charge third parties for access to its application programming interface or API. The API gives third-party apps access to Reddit data. These changes put an end to the social network’s homespun origins and add a new revenue stream.

At $5bn, Reddit would be valued on a multiple of just over six times estimated trailing sales. That would put it well below both Meta and online scrapbook Pinterest. It would be valued at roughly the same multiple as Snap, despite growing at a faster clip.

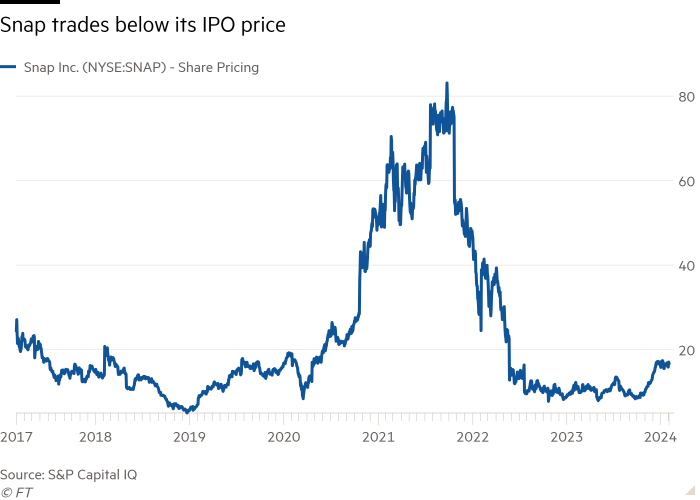

Compare Reddit’s IPO to Snap’s and it is clear how interest in social media has changed. When Snap joined markets in 2017 its listing price valued the company at about 60 times trailing revenue. The co-founders were able to grant themselves voting control. Yet the messaging company, which has also yet to announce a full year of profit, still trades below its IPO price. On Monday, it announced plans to lay off a 10th of its workforce.

Reddit is unlikely to attempt a Snap-style voting right division. But it is likely to float a relatively small number of shares, perhaps equal to 10 per cent of the company. The co-founders and other investors may not have a controlling stake but new investors in the company are not going to have much of a say either.