Stay informed with free updates

Simply sign up to the Japanese business & finance myFT Digest — delivered directly to your inbox.

In towns and cities across Japan the distinctive, delirious buildings of the Bubble era still abound: each one telling a tale of how thoroughly excess and exuberance show their age once the fuel is spent.

These were built during Japan’s frothiest days of the late 1980s. More than enough remain to provide ordinary Japanese with daily visual reminders of what bubbly optimism looked like — and, as the buildings have decayed over three decades, its opposite.

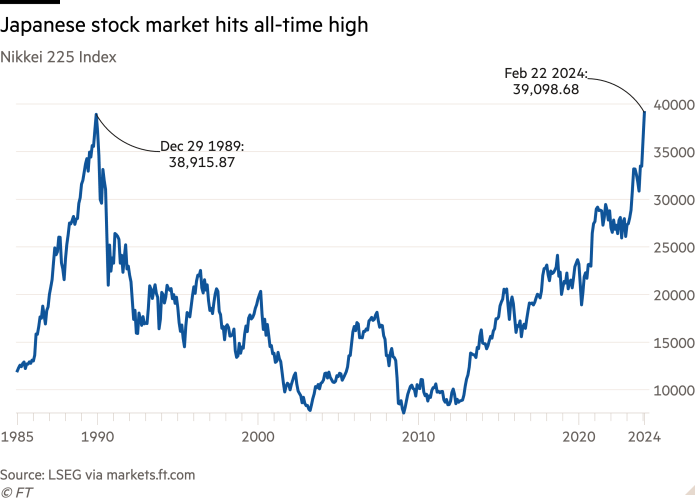

The failure of the flawed but widely followed Nikkei 225 stock average to regain its 1989 peak for 34 long years performed a similar function in keeping the trauma of the bubble on permanent public display, impeding a clean psychological exit from the episode.

Japanese stocks this week finally surpassed the peak (only in nominal terms, mind) after a 17.5 per cent rise this year. The great question now is whether this will actually be taken by the endlessly patient Japanese public as marking the end of the post-bubble era. And, if it is, whether Japanese households decide it is time to channel some of their $7.7tn hoard of cash and deposits into domestic stocks that, even here, look cheap compared with those in the US. The Bank of Japan calculates that only 13 per cent of Japan’s liquid household assets are in equities, against more than 40 per cent in the US and 21 per cent in Europe.

Certainly, in the excitement of this week, traders, brokerage chiefs, analysts and market historians were all keen to identify the “psychological barrier” that had been broken. It may take more than that, though, to confidently call the start of a new domestic-led investment era.

The general reluctance of Japanese households to invest more enthusiastically in their own equity market has been a live debate for years. Many explanations are plausible but the simplest is the damping effect of that high profile Nikkei 225 chart showing that over a 34-year timeframe Japanese stocks lose their value.

To a significant extent, the non-investment by households has held firm despite an impressive barrage of efforts to persuade them that the risks and rewards are now more than acceptable. The Tokyo Stock Exchange has embarked on a campaign to make companies more transparent and more focused on raising corporate value. Brokerages have heavily marketed tax-protected Nippon Individual Savings Accounts, in which the government allowed individuals to invest more capital from the beginning of 2024. And for much of the last 10 years, the Bank of Japan routinely stepped into the Japanese equity market to buy Topix and Nikkei ETFs in the afternoon if stocks had fallen too heavily in the morning.

On the corporate side, the state has pushed through governance reforms on companies and stewardship reform on institutional investors. Companies have, in a great many cases, become leaner, more globalised and more profitable. A tentative rise in domestic mergers and acquisitions might be just starting to create a long-absent market for corporate control; buybacks are at a record; and chief executives are more conscious of the need to focus on core operations.

And then there have been the macro factors that should, in theory, be pushing Japanese household wealth into Japanese shares. The yen is weak, which is helpful for the profits of many Japanese companies. China is now a far less straightforward destination for global funds and Japanese stocks are increasingly of interest.

The return to Japan of sustained inflation, after its multi-decade absence, is already proving pivotal. Companies look primed to raise wages in a way that could reheat tepid consumer confidence. And rising prices should, in theory, propel Japan’s ever growing ranks of retirees to seek the kind of yields readily available in domestic stocks.

Foreign investors, of course, are strongly drawn to this great confluence of factors: they collectively ploughed a net $43bn into Japanese equities in 2023 and have been enthusiastic buyers in the first months of 2024. Japanese individuals, meanwhile, have still not taken the bait.

Official data for the usage of the newly expanded NISA programme from January to March will not be available until May, but two trends are already evident. Equity funds in January saw a huge $9.3bn net inflow of capital with most of that thought to have been propelled by NISA. Since then, brokers say the overwhelming (some estimate as much as 90 per cent) of money has been directed at funds tracking global equity markets and, in particular the US S&P 500 index.

Japanese households, in other words, have been looking at their favourite Nikkei index heading to its peak and have still decided that the long-term shape of the US benchmark is the right one to bet on. Ironically, though, the rise in the US stocks lifts the Japanese market. That paradox may sooner or later provide the incentive Japanese individuals need to start trusting the tailwinds behind their own market. In the longer term they will be looking for reassurance that Japanese stocks really have passed the post-bubble era.