Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Terrible weather is a drag on everyone’s mood. More expensive weather is likely to be the same.

Changing weather will cost us all more in years to come, according to Swiss Re. There were more loss-inducing natural events than ever last year, according to the reinsurer, as well as it being the hottest year on record. That will be costly for homeowners. Oddly, it is not — yet — for the reinsurance industry.

Insured losses of $108bn for 2023 were broadly in line with the five-year average. That is despite the fact that there were few single large loss events such as major hurricanes, the type of catastrophe that is often the focus of climate concerns. Instead, low intensity disasters such as severe storms pushed losses higher.

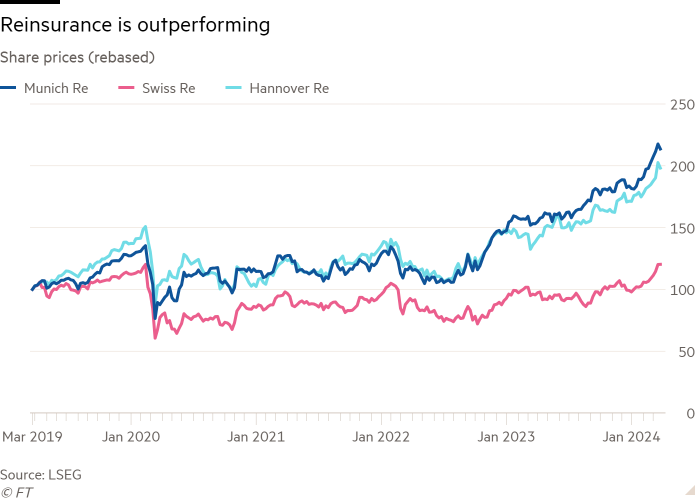

For investors in reinsurers like Swiss Re, this is good news. Fewer large loss events helped shares in Swiss Re climb to levels last reached before the financial crisis; peers are at record highs. Reinsurance returns last year were 20 per cent, according to brokerage Guy Carpenter. Global reinsurers have little exposure to lower intensity storms.

But these severe convective storms (or SCS) are bad news for buyers of home insurance. More localised than hurricanes, these are characterised by strong winds and hailstones. This second feature explains the sharp increase in insured losses in recent years: at $60bn, SCS losses hit a record high last year, more than double the annual average losses in the previous decade. Most came in the US and much of that was down to hailstone damage to rooftops and solar panels.

The result is that home insurance costs are rising fast, up by a fifth in the US on average last year. While climate change is the root cause, this is exacerbated by behavioural and economic factors such as urbanisation and more people moving to coastal regions.

More capital is needed to stop a protection gap for homeowners growing larger. Swiss Re puts the portion of expected catastrophe losses that are uninsured in developed markets at 63 per cent. Higher prices are enticing money in, with available capital up 10 per cent last year. But that is unlikely to continue as larger loss events pick up again.

The reinsurance industry says it cannot currently price the type of localised risk that is pushing up home insurance costs and leading to reduced coverage in states like California. Better building standards could curb rising losses. More investment in climate change mitigation could do the same. But for now, there is little to stop homeowners bearing an ever-higher price to offset the risks posed by the weather.