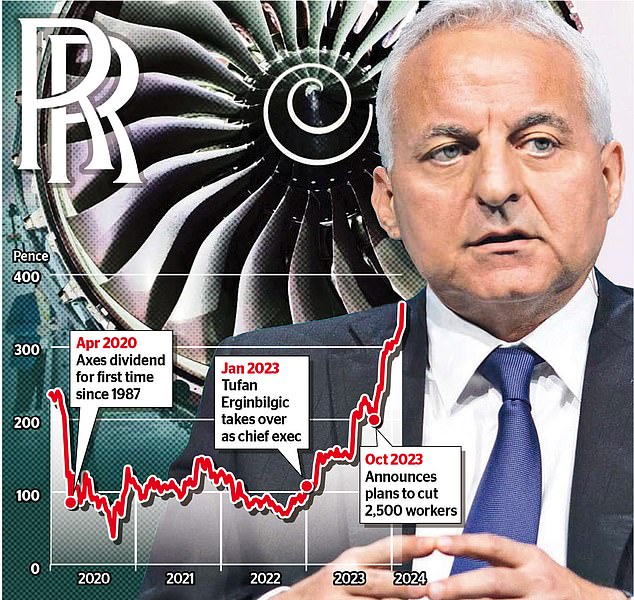

Rolls-Royce more than doubled profits last year as a turnaround led by boss Tufan Erginbilgic paid off amid a recovery in air travel.

The engineering giant made £1.6billion in 2023, up from £652million in the previous year, sending its share price up as much as 11 per cent.

And it has forecast further growth, with earnings on track to hit up to £2billion in 2024.

Earnings for last year beat analysts’ expectations of £1.4billion but the firm’s investors were left without a shareholder payout. The British defence company last paid a dividend in 2019.

Rolls-Royce explained that it was committed to resuming dividends once ‘the strength of our balance sheet is assured’.

Big boost: Profits at Rolls-Royce have risen by more than 200% since Tufan Erginbilgic (pictured) took over as boss

Julie Palmer, a partner at Begbies Traynor, said: ‘Rolls-Royce investors might feel short-changed by the lack of shareholder payments, despite the improved performance in 2023.’

Since former BP executive Erginbilgic, who has pledged to quadruple profits by 2027, took over the 118-year-old group in January 2023, shares have soared more than 200 per cent.

Yesterday, they climbed 8.3 per cent, or 27.3p, to 356.8p. Rolls was the FTSE 100’s biggest riser in 2023, with shares enjoying their best year since the 1987 public listing.

Erginbilgic said: ‘Our transformation has delivered a record performance in 2023, driven by commercial optimisation, cost efficiencies and progress on our strategic initiatives.’

Rolls spent years underperforming under previous bosses and came close to bankruptcy during the pandemic.

When Erginbilgic took over last year he described the firm as a ‘burning platform’.

Yesterday, it confirmed that it had already made £150million of the between £400million to £500million cost savings outlined in a transformation plan.

Last year it announced plans to cut 2,500 jobs, which is up to 6 per cent of its workforce, a measure that will mainly affect non-engineering roles.

Rolls is targeting making a profit of £2.8billion by 2027 and is hoping to fatten margins at its main civil aerospace business to as much as 17 per cent.

The company forecast operating profit of between £1.7billion and £2billion for 2024 but warned that supply chain ‘challenges’ would continue for up to another two years.

Erginbilgic also used the results to take a swipe at the Government, warning that the first of its mini-nuclear reactors could be built in Europe instead of Britain if ministers fail to accelerate their decision-making.

He said he was confident the Derby company’s small modular reactor (SMR) technology was still far ahead of competitors.

But he said time was running out for the UK to benefit from its ‘first mover’ advantage, as Rolls has also held talks about deploying SMRs in eastern Europe.

It comes as Great British Nuclear (GBN), the public body that was set up to lead the UK’s nuclear power revival, is preparing to choose which SMR prototypes to support from a shortlist of six companies, including Rolls.

After delays to the process, GBN has promised that it will unveil winners this spring.

But Erginbilgic warned the selection would ‘not mean anything’ unless detailed decisions are taken within months on where the reactors will be built.

Quilter Cheviot equity analyst Jarek Pominkiewicz said: ‘The impressive results were supported by the company’s transformation programme and strategic initiatives, which aimed to improve its commercial optimisation and cost efficiency across the group… the recovery is very much on track.’

The engine maker said revenue jumped 21 per cent from £12.7billion to £15.4billion last year.

Sales were boosted as governments upped their military spending amid heightened global tensions in 2023.

And a recovery in air travel, as demand for holidays soared, helped to push up sales and profits.

In its civil aerospace business, large-engine flying hours – a key performance measure – recovered to 88 per cent of 2019 levels, up from 65 per cent in 2022.

Orders for large engines hit a 15-year high, with major purchases by Air India and Turkish Airlines.

And the company forecast that transactions will bounce back or beat pre-pandemic levels by the end of 2024.