Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

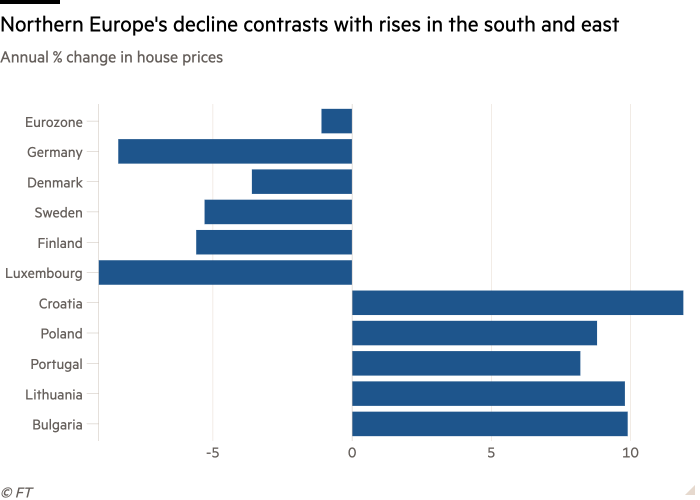

European house prices fell for the first time in a decade last year, as strong growth in the property markets of some eastern and southern countries was masked by declines in many northern EU states.

Residential property prices fell 0.3 per cent in the EU in 2023 and 1.1 per cent in the eurozone, according to data from Eurostat on Thursday.

Germany’s housing market was one of the worst hit with a decline of 8.4 per cent on an annual basis, second only to Luxembourg with a 9.1 per cent drop. It was followed by Finland on 5.6 per cent and Sweden on 5.3 per cent.

Yet prices surged in some countries, including Croatia, Bulgaria, Lithuania, Poland and Portugal, where they rose between 8 and 12 per cent.

Economists said stronger economic growth in southern and eastern European countries in recent years had helped their housing markets to keep rising, while core countries — such as Germany and France — had suffered from stagnant or weak growth.

“Recent underperformance of the German economy is adding to caution from actual and prospective buyers and the strong house price surge during the pandemic also left the German market vulnerable to a correction,” said Ricardo Amaro at Oxford Economics.

Amaro said “supply dynamics” could help to explain the outperformance of some country’s housing markets, particularly in southern Europe “where new construction has been weak”.

There are additional country-specific factors behind some stronger markets. Croatia has had an influx of investment since joining the euro in January 2023. Portugal’s housing market has been boosted by tax incentives for purchasers of second homes and the offer of “golden visas” for wealthy foreigners buying property, both of which the government is removing.

Poland’s housing market was “benefiting both from its strong economic growth and the added boost of two interest rate cuts last year”, said Carsten Brzeski, global head of macro research at Dutch bank ING.

House prices had fallen more in some countries — such as Germany — after steep gains left them starting to look overvalued compared with rents or household incomes, said Andrew Kenningham at Capital Economics.

“In contrast, in some southern eurozone economies — like Spain — they were still looking quite low and had not fully recovered from the big housing market corrections during the global financial crisis and eurozone crisis,” he said.

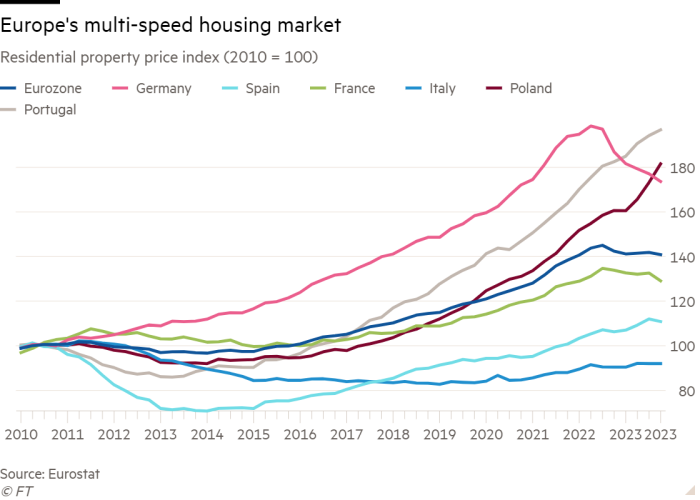

Some countries — like Italy or Finland — have house prices at similar levels to where they were a decade ago, while others like Poland, Portugal and Lithuania have witnessed a more than doubling of residential property prices in that time.

Eurostat did not include Greek data. But Greece’s housing market has been one of the strongest in the region according to data from the Bank of Greece, which recently showed residential property prices rose 13.4 per cent last year.

The recent correction in the eurozone’s housing market has been much less severe than initially feared, in spite of prices rising almost 50 per cent in the decade after the region’s sovereign debt crisis started in 2012.

On a quarterly basis, EU prices fell 0.3 per cent in the last three months of 2023 compared with the previous quarter and eurozone prices fell by 0.7 per cent.

Prices peaked in the third quarter of 2022, shortly after the European Central Bank started raising interest rates in response to the biggest inflation surge for a generation.

Critics of the ECB blamed its ultra-loose policy until 2022 for inflating asset price bubbles, particularly in property, over the past decade. But since the central bank started raising its benchmark deposit rate to reach a record high of 4 per cent last year, eurozone house prices have fallen only 2.9 per cent, according to Eurostat data.

“The ECB has not done much to burst the bubble by raising rates, which is remarkable and shows that supply of new housing is extremely constrained in many countries,” said Brzeski.

He said there were already signs that house prices were recovering in Germany at the start of this year after the country’s lenders cut their mortgage rates, while broker Interhyp said January had been its busiest ever month for customer inquiries.