-

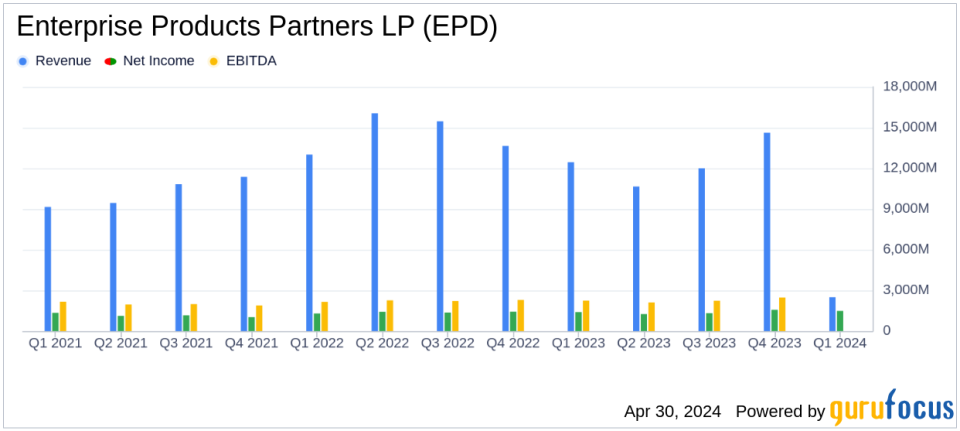

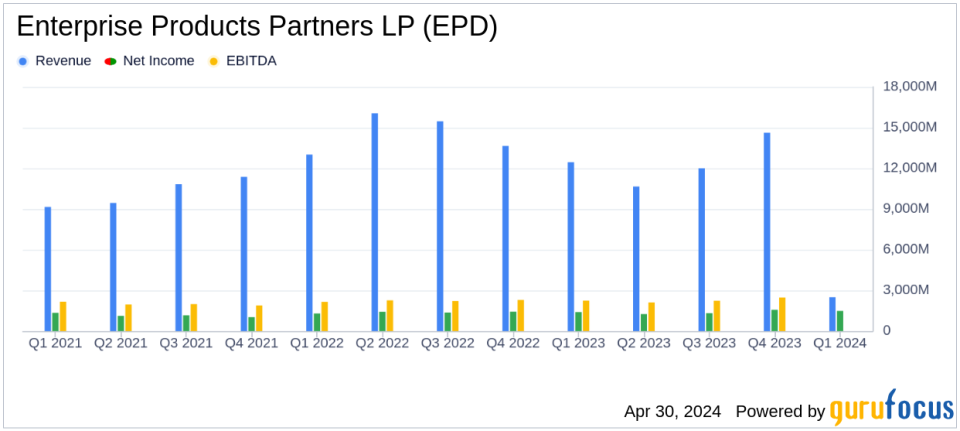

Net Income: Reported $1.5 billion for Q1 2024, a 5% increase from $1.4 billion in Q1 2023, slightly surpassing the estimate of $1.459 billion.

-

Earnings Per Share: Achieved $0.66 per unit, up from $0.63 per unit year-over-year, falling just short of the estimated $0.67.

-

Revenue: Reached $14.76 billion, showing a significant rise from $12.44 billion in the previous year and exceeding the estimated $14.229 billion.

-

Distributable Cash Flow: Maintained at $1.9 billion, consistent with the previous year, supporting a 5.1% increase in quarterly distributions to $0.515 per unit.

-

Capital Investments: Totalled $1.1 billion, with $875 million directed towards growth initiatives, indicating robust ongoing investment in infrastructure.

-

Debt and Liquidity: Ended the quarter with $29.7 billion in total debt and approximately $4.5 billion in consolidated liquidity, ensuring strong financial flexibility.

-

Unit Buyback: Repurchased approximately $40 million of common units, utilizing 48% of the authorized $2 billion buyback program.

On April 30, 2024, Enterprise Products Partners L.P. (NYSE:EPD) disclosed its first-quarter financial results through its 8-K filing. The company, a leading provider in the midstream energy sector, reported a net income of $1.5 billion, or $0.66 per unit, aligning closely with analyst expectations of $0.67 per share. This marks a modest increase from the previous year’s $1.4 billion, or $0.63 per unit. Total revenue for the quarter reached $14.76 billion, surpassing the estimated $14.23 billion, reflecting a robust performance amidst dynamic market conditions.

Enterprise Products Partners operates a vast network of facilities essential for the processing and transportation of energy commodities like natural gas and crude oil. Its strategic operations span across key producing regions in the United States, making it a pivotal entity in the energy sector.

Financial and Operational Highlights

The company’s operational success in the first quarter is evident from its increased distributable cash flow (DCF), which remained stable at $1.9 billion. The DCF coverage ratio stood at 1.7 times the distribution, which has been increased by 5.1% to $0.515 per common unit. This financial maneuvering showcases Enterprises commitment to delivering value to its stakeholders while retaining substantial cash flow to fund future capital projects and unit buybacks.

Enterprise’s total capital investments were noteworthy at $1.1 billion, focusing predominantly on growth-oriented projects. This aligns with their strategic initiatives to enhance infrastructure capabilities across various segments. The company also reported a strong liquidity position with approximately $4.5 billion available, ensuring resilience and operational stability.

Segment Performance and Future Outlook

The NGL Pipelines & Services segment was a significant contributor to the quarter’s success, generating a gross operating margin of $1.3 billion, up from $1.2 billion in the previous year. This was supported by increased pipeline transportation and fractionation volumes, which are crucial for the processing and distribution of natural gas liquids.

Looking ahead, Enterprise is poised for continued growth with substantial investments planned in organic growth capital projects, estimated between $3.25 billion to $3.75 billion for 2024 and 2025. These investments are expected to further solidify Enterprise’s market position and enhance shareholder value.

Market and Economic Implications

The company’s performance is particularly notable against the backdrop of fluctuating energy prices and varying market demands. Enterprise’s ability to maintain stable cash flows and increment distributions amidst these conditions speaks volumes about its operational efficiency and strategic foresight.

In conclusion, Enterprise Products Partners L.P.’s first-quarter results for 2024 reflect a solid financial standing and promising growth prospects. The alignment of its actual earnings with analyst projections, coupled with strategic capital investments and a strong liquidity position, positions EPD favorably for sustained growth and stability in the competitive energy sector.

For detailed financial metrics and further information, refer to the full 8-K filing on the SEC website.

Explore the complete 8-K earnings release (here) from Enterprise Products Partners LP for further details.

This article first appeared on GuruFocus.