The FTSE 100 is down 0.8 per cent in early trading. Among the companies with reports and trading updates today are 888 and Home REIT. Read the Friday 19 April Business Live blog below.

> If you are using our app or a third-party site click here to read Business Live

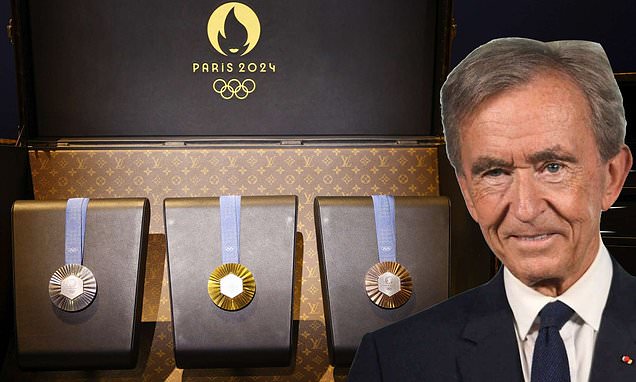

The luxury giant going for gold at the Paris Olympics – from dressing Team France, to supplying champagne

Middle East tensions rattle markets

888 shares rise as William Hill owner posts forecast-beating revenues

Market open: FTSE 100 down 0.4%; FTSE 250 off 0.6%

Hunt raises alarm over bid for Royal Mail as ‘Czech Sphinx’ plots fresh swoop

Home REIT raises £15.9m from 65 properties sale

888 revenues beat forecasts

Two female BP execs to leave in first reshuffle since Looney stepped down

Why retail sales are set to ‘gradually improve’

No Easter bounce for retailers

Retail sales stagnate in March