Assenagon Asset Management S.A. increased its stake in shares of Axon Enterprise, Inc. (NASDAQ:AXON – Free Report) by 433.4% in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 18,281 shares of the biotechnology company’s stock after buying an additional 14,854 shares during the quarter. Assenagon Asset Management S.A.’s holdings in Axon Enterprise were worth $4,723,000 at the end of the most recent reporting period.

Assenagon Asset Management S.A. increased its stake in shares of Axon Enterprise, Inc. (NASDAQ:AXON – Free Report) by 433.4% in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 18,281 shares of the biotechnology company’s stock after buying an additional 14,854 shares during the quarter. Assenagon Asset Management S.A.’s holdings in Axon Enterprise were worth $4,723,000 at the end of the most recent reporting period.

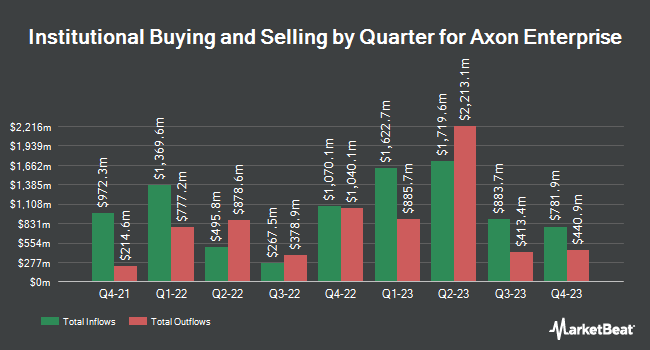

Several other hedge funds and other institutional investors have also modified their holdings of AXON. Capital International Investors lifted its position in shares of Axon Enterprise by 605.2% during the 1st quarter. Capital International Investors now owns 2,660,634 shares of the biotechnology company’s stock worth $366,449,000 after buying an additional 2,283,343 shares during the period. Sands Capital Management LLC raised its position in Axon Enterprise by 101.6% in the 2nd quarter. Sands Capital Management LLC now owns 1,993,126 shares of the biotechnology company’s stock valued at $388,899,000 after purchasing an additional 1,004,556 shares during the last quarter. BlackRock Inc. raised its position in Axon Enterprise by 11.7% in the 1st quarter. BlackRock Inc. now owns 8,329,479 shares of the biotechnology company’s stock valued at $1,872,883,000 after purchasing an additional 870,481 shares during the last quarter. Norges Bank bought a new position in Axon Enterprise in the 4th quarter valued at $102,920,000. Finally, State Street Corp raised its position in Axon Enterprise by 22.6% in the 2nd quarter. State Street Corp now owns 2,915,214 shares of the biotechnology company’s stock valued at $568,817,000 after purchasing an additional 538,119 shares during the last quarter. Institutional investors own 79.08% of the company’s stock.

Insider Buying and Selling

In other Axon Enterprise news, President Joshua Isner sold 35,400 shares of the business’s stock in a transaction dated Tuesday, January 2nd. The stock was sold at an average price of $251.68, for a total value of $8,909,472.00. Following the completion of the transaction, the president now directly owns 309,564 shares of the company’s stock, valued at $77,911,067.52. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. 6.10% of the stock is owned by insiders.

Axon Enterprise Stock Down 0.9 %

Shares of Axon Enterprise stock opened at $312.88 on Monday. The company has a quick ratio of 2.66, a current ratio of 3.00 and a debt-to-equity ratio of 0.42. Axon Enterprise, Inc. has a 12 month low of $175.37 and a 12 month high of $325.63. The business has a fifty day simple moving average of $285.73 and a 200 day simple moving average of $247.37. The stock has a market cap of $23.61 billion, a PE ratio of 136.04 and a beta of 0.93.

Axon Enterprise (NASDAQ:AXON – Get Free Report) last announced its quarterly earnings data on Tuesday, February 27th. The biotechnology company reported $0.77 EPS for the quarter, topping analysts’ consensus estimates of $0.48 by $0.29. Axon Enterprise had a return on equity of 14.11% and a net margin of 11.14%. The business had revenue of $432.14 million during the quarter, compared to analysts’ expectations of $418.97 million. Research analysts predict that Axon Enterprise, Inc. will post 2.43 EPS for the current year.

Analysts Set New Price Targets

Several brokerages have issued reports on AXON. Argus began coverage on Axon Enterprise in a research report on Wednesday, March 13th. They issued a “buy” rating and a $380.00 price objective for the company. JPMorgan Chase & Co. lifted their price objective on Axon Enterprise from $285.00 to $330.00 and gave the company an “overweight” rating in a research report on Wednesday, February 28th. Robert W. Baird boosted their target price on Axon Enterprise from $260.00 to $300.00 and gave the stock an “outperform” rating in a research report on Thursday, February 22nd. StockNews.com downgraded Axon Enterprise from a “buy” rating to a “hold” rating in a research report on Thursday, March 14th. Finally, The Goldman Sachs Group boosted their target price on Axon Enterprise from $297.00 to $339.00 and gave the stock a “buy” rating in a research report on Wednesday, February 28th. Two equities research analysts have rated the stock with a hold rating and ten have given a buy rating to the company’s stock. Based on data from MarketBeat.com, Axon Enterprise has a consensus rating of “Moderate Buy” and a consensus price target of $301.73.

View Our Latest Stock Report on AXON

About Axon Enterprise

Axon Enterprise, Inc develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally. It operates through two segments, Software and Sensors, and TASER. The company also offers hardware and cloud-based software solutions that enable law enforcement to capture, securely store, manage, share, and analyze video and other digital evidence.

Featured Stories

Want to see what other hedge funds are holding AXON? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Axon Enterprise, Inc. (NASDAQ:AXON – Free Report).

Receive News & Ratings for Axon Enterprise Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Axon Enterprise and related companies with MarketBeat.com’s FREE daily email newsletter.