The telco, formed by the merger of Aditya Birla Group’s Idea Cellular and the India unit of Vodafone Plc in 2018, has priced the issue at Rs 10-11 a share. At the higher end of the band, the issue is priced at around a 26% discount to the Rs 14.87 a share that was recently set for the preferential issue to one of the promoters.

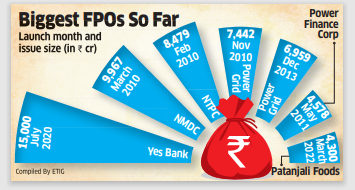

The largest FPO prior to this was conducted by Yes Bank in July 2020, raising Rs 15,000 crore. In February last year, Adani Enterprises abruptly cancelled its Rs 20,000 crore FPO, just a day after successfully closing the offer. This followed a 28.5% decline in the share price in the wake of the Hindenburg Research report.

The board approved the FPO “aggregating up to Rs 18,000 crore”, Vodafone Idea said in a statement Friday. The pricing is at “a discount of around 15% compared to last closing price of Rs 12.95”, it said.

“Despite the discount of 15-17%, Vi’s path to a near-term revival seems uncertain,” said Shivani Nyati, head of wealth, Swastika Investmart. “While the fundraising could strengthen Vi’s infrastructure, the company faces challenges on the financial front. A potential financial crunch looms in 2026 when significant spectrum and AGR (adjusted gross revenue) dues of up to $4 billion become payable.”

Vi’s stock came off an intraday low of Rs 12.23 to close 0.2% higher at Rs 12.96 on the BSE on Friday, despite the overall weakness in the market.The Indian government is the largest shareholder in Vi, with a stake of more than 33%, which it got in lieu of dues as part of a previous rescue plan.The equity funding worth Rs 20,000 crore, including the share issue to a promoter entity, would mean a dilution of around 26%, according to analysts.

The telco said Friday that its Capital Raising Committee will meet on April 16 to allocate equity shares to successful anchor investors.

A person familiar with the matter had earlier told ET that the equity meant for anchor investors, reserved for qualified institutional buyers (QIBs), has been fully subscribed already. Half the book in an FPO is usually reserved for QIBs, 35% for retail investors and the rest for high-net-worth individuals (HNIs).

The board of the loss-making telco last week approved a preferential share issue to raise Rs 2,075 crore from an Aditya Birla Group (ABG) entity, Oriana Investments Pte Ltd. That set the stage for a wider Rs 45,000-crore funding programme, including Rs 25,000 crore of debt, key to helping the telco compete effectively against rivals Reliance Jio and Bharti Airtel, and stem rapid subscriber losses.

It needs funds to repay vendors such as tower company Indus Towers, strengthen its 4G network and fund the launch of 5G services. Jio and Bharti Airtel have already completed the pan-India rollout of 5G services.

The person cited above had told ET earlier that debt funding of around Rs 25,000 crore will take place shortly after the FPO closes.

“Completion of the planned Rs 450 billion fund raise should enable VIL to ramp up network capex and narrow the gap with peers on 4G coverage and 5G rollouts,” Citi Research said in a note. “Combined with potential tariff hikes after elections and possibility of AGR relief (matter pending in Supreme Court), this should significantly boost VIL’s cash flow position.”

The company may still face a cash shortfall in the second half of FY26 once the ongoing moratorium on the government’s AGR and spectrum repayments ends, unless the Centre exercises the option to convert these dues into equity, Citi added. The AGR dues amount to Rs 70,000 crore.

Goldman Sachs recently estimated that in the absence of headline rate increases, Vi requires $8-10 billion (Rs 65,000-83,000 crore) of fresh capital over the next two years to build a mobile broadband network that can compete with Airtel and Jio.

Vi’s net debt widened to Rs 2.14 lakh crore in the fiscal third quarter and cash and cash equivalents were at Rs 318.9 crore. Its bank debt currently stands at about Rs 4,500 crore.

The company’s gross mobile user base shrank by another 1.02 million to 222.5 million at the end of February. Market leader Jio added 3.59 million and Airtel gained 1.53 million users to end February with 467.48 million and 384.01 million subscribers, respectively.

Axis Capital, Jefferies, and SBI Capital have been appointed bankers to the public offer.