Stay informed with free updates

Simply sign up to the UK house prices myFT Digest — delivered directly to your inbox.

UK house sales rose for the seventh consecutive month in April, according to data from property platform Zoopla, suggesting that lower mortgage rates are fuelling a market rebound.

The number of sales agreed rose by an annual rate of 12 per cent in the four weeks to April 21, marking an uninterrupted increase since October last year, Zoopla data showed on Monday.

“The rebound in sales being agreed continues as mortgage rates have fallen, consumer confidence improves and home buyers have much greater choice of homes for sale,” said Richard Donnell, executive director at Zoopla.

The rise in property sales this year reverses an almost two-year decline. The figure for April was broadly unchanged from the 13 per cent registered in March.

Zoopla, which tracks housing activity via its online platform, said the average estate agent had 14 per cent more properties on the market in the past four weeks than during the same time last year. There were also a fifth more homes for sale compared with a year ago.

The figures suggest the rebound in mortgage approvals seen in data from the Bank of England is likely to continue, as pressure on households previously squeezed by high borrowing costs begins to ease. UK mortgage approvals rose to a 17-month high in February.

Mortgage rates have fallen from their peak last summer. However, since February many lenders have raised their offers reflecting disappointing inflation data, which prompted markets to price that the BoE will keep interest rates higher for longer.

Markets anticipate the central bank will cut interest rates from their 16-year high of 5.25 per cent by 40 basis points by the end of 2024, with the first cut expected in September.

Matt Thompson, head of sales at the estate agent Chestertons, said: “The uplift in market activity typically associated with spring was slightly delayed this year but became more evident in the course of April.”

Zoopla said the market was on track for 1.1mn sales in 2024, up 10 per cent on 2023. It also reported that its house price index, based on property valuation computed by Hometrack, was largely unchanged in March from last year.

Across the country, the average property price was £264,459 in March, 0.2 per cent down from the same month of last year, but with considerable regional variation.

Prices were up year-on-year in northern England, West Midlands, Wales, Scotland and Northern Ireland, but fell in London, the South and the East.

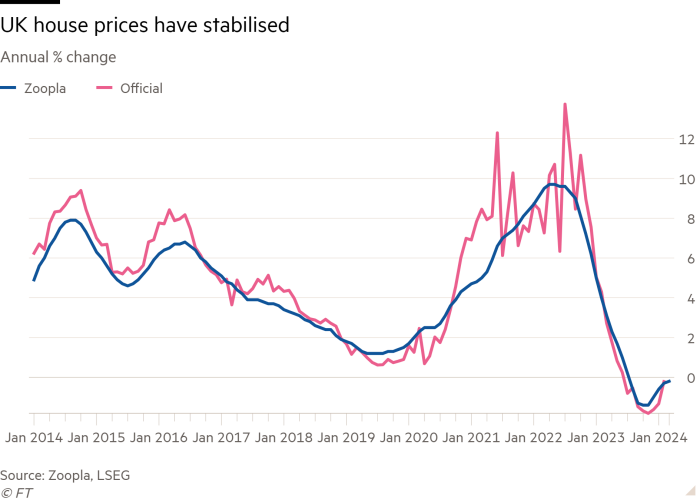

The Zoopla house price tracks closely, but with less volatility, the official house price index for which data is available up to February.

Donnell said the housing market “continues to adjust to higher mortgage rates. What the market needs most is continued price stability, which will create the environment for continued growth in sales”.